Housing Without Demand

Growth | Business Strategies | August 2025

Content we will read:

Housing Market in Tehran | Volume of Real Estate Transactions | Investment in Real Estate

Reading time: 5 minutes

Why Has Tehran’s Housing Market Become Buyerless?

In recent years, Iran’s housing market—especially in metropolises—has faced a combination of inefficiencies in the bank-centered financing system, a sharp decline in transactions and deals, high inflation expectations, rising construction costs, and liquidity constraints.

Key housing sector indicators—including the continuous decrease in the loan-to-value (LTV) ratio, rising prices in dollar terms, and the growing share of housing costs in household expenditures—all testify to the serious weakening of buyers’ purchasing power. In other words, the housing market is no longer a place frequented by genuine buyers.

These changes have not only disrupted the balance between housing supply and demand, but their prolonged persistence has effectively diminished and worn down the real buyers’ ability to participate.

In this analysis, we aim to review some of the reasons behind the decline in demand in Iran’s housing market and uncover the forces driving these changes.

The continuous decrease in the loan-to-value (LTV) ratio, rising prices in dollar terms, and the growing share of housing costs in household expenditures—all testify to the serious weakening of buyers’ purchasing power.

Housing Market’s Compass: The Dollar

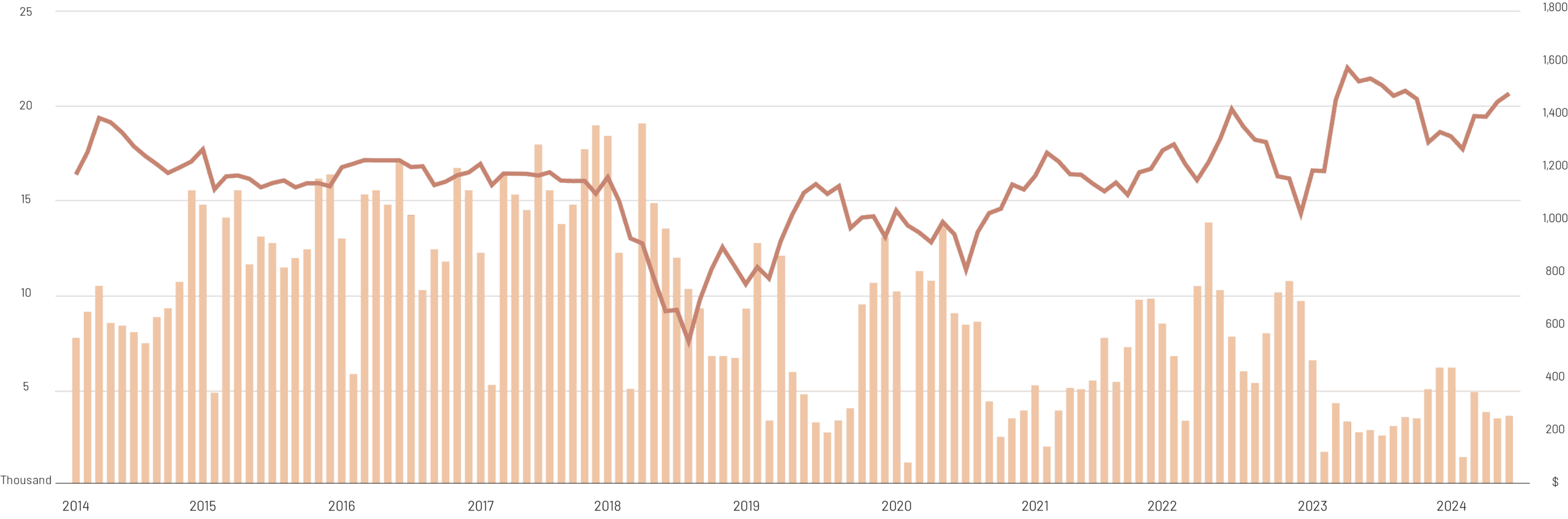

Based on data on housing transactions and prices in dollar terms in Tehran, it is clearly observable that since 2018, an inverse relationship has formed between price and transaction volume, which has gradually become more prominent and intensified. During this period, despite repeated fluctuations and jumps in dollar prices, the volume of transactions faced an unprecedented downward trend.

Even in the years 2018 to 2020, when the rise in the exchange rate led to a decrease in housing prices measured in dollars, this relative price drop did not result in a significant return of buyers; instead, due to economic volatility, the market remained stagnant.

From the beginning of the 2020s, dollar-denominated housing prices resumed an upward trajectory, rising from around $1,000 to over $1,500, while transactions stabilized at very low levels.

The data clearly shows that the housing market is highly sensitive to dollar prices, and effectively, the purchasing power of end consumers in housing has gradually eroded.

Volume of Housing Transactions in Tehran

Dollar-denominated Price per Square Meter of Housing in Tehran

Dollar appreciation trend and number of housing transactions

What Are Catastrophic Housing Costs?

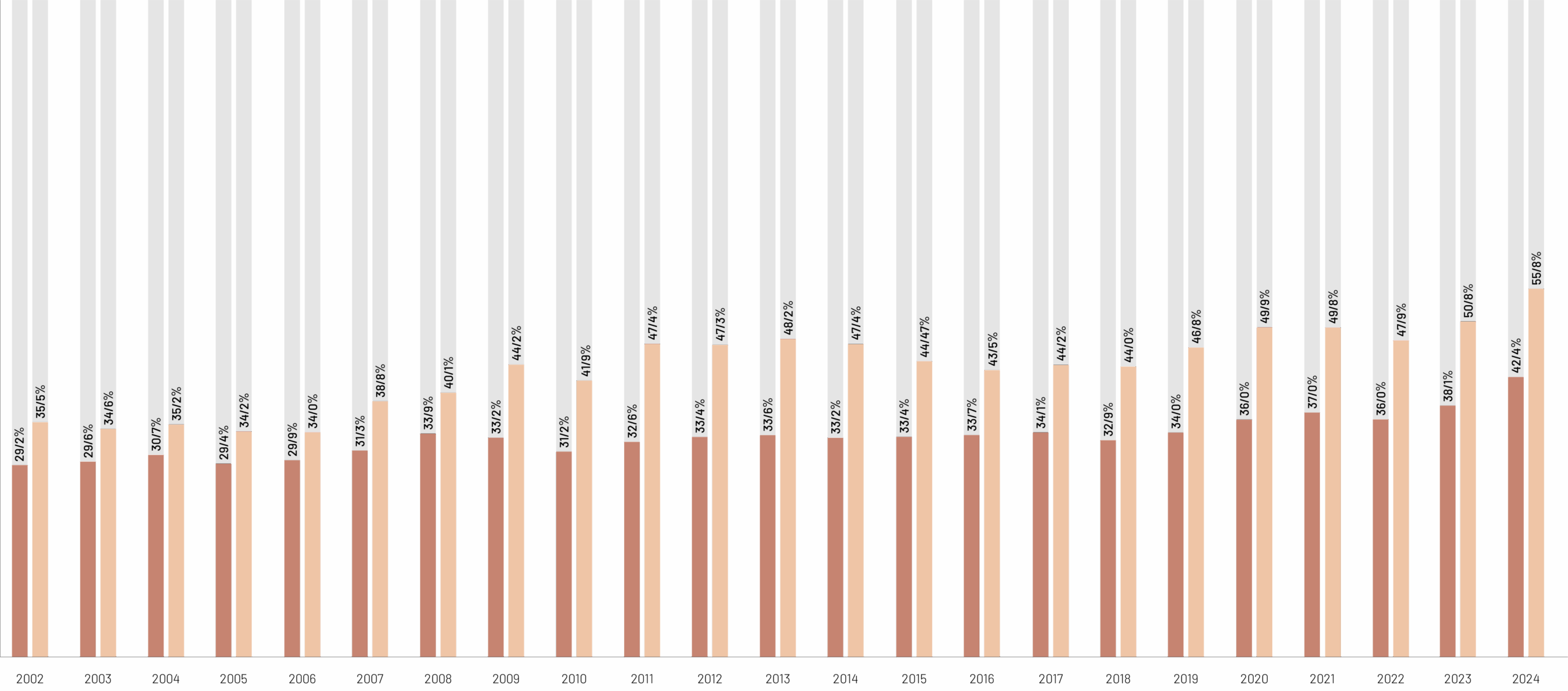

The United Nations and the World Bank define an acceptable ratio for housing costs at up to 30% of a city household’s total income. According to global standards, if housing expenses (including rent, water, electricity, and fuel) exceed 30% of a household’s total expenditures, this situation is classified as catastrophic expenditures.

In an international comparison, countries like Finland ( 29.3%) and Slovakia ( 30.4%) are among those with the highest housing cost burdens in Europe—yet their levels remain below the estimates reported for Iran. On the other hand, countries such as Qatar ( 21.1%) and Albania ( 11.7%) experience the lowest housing cost burdens on households.

In Iran, particularly in a major city like Tehran, this indicator has reached a critical level—almost double the global standard—close to 60%. This crisis stems from a combination of factors such as inflation expectations in the housing sector, rising property prices, and inefficient housing policies. The consequences include reduced purchasing power, increased rental rates, declining economic security for the middle and lower classes, and ultimately a widening social inequality gap.

The United Nations and the World Bank define an acceptable ratio for housing costs at up to 30% of a city household’s total income.

Housing Cost Share of Urban Households in Tehran

Housing Cost Share of Urban Households Nationwide

Dollar appreciation trend and number of housing transactions

The Threshold of Purchasing Inability

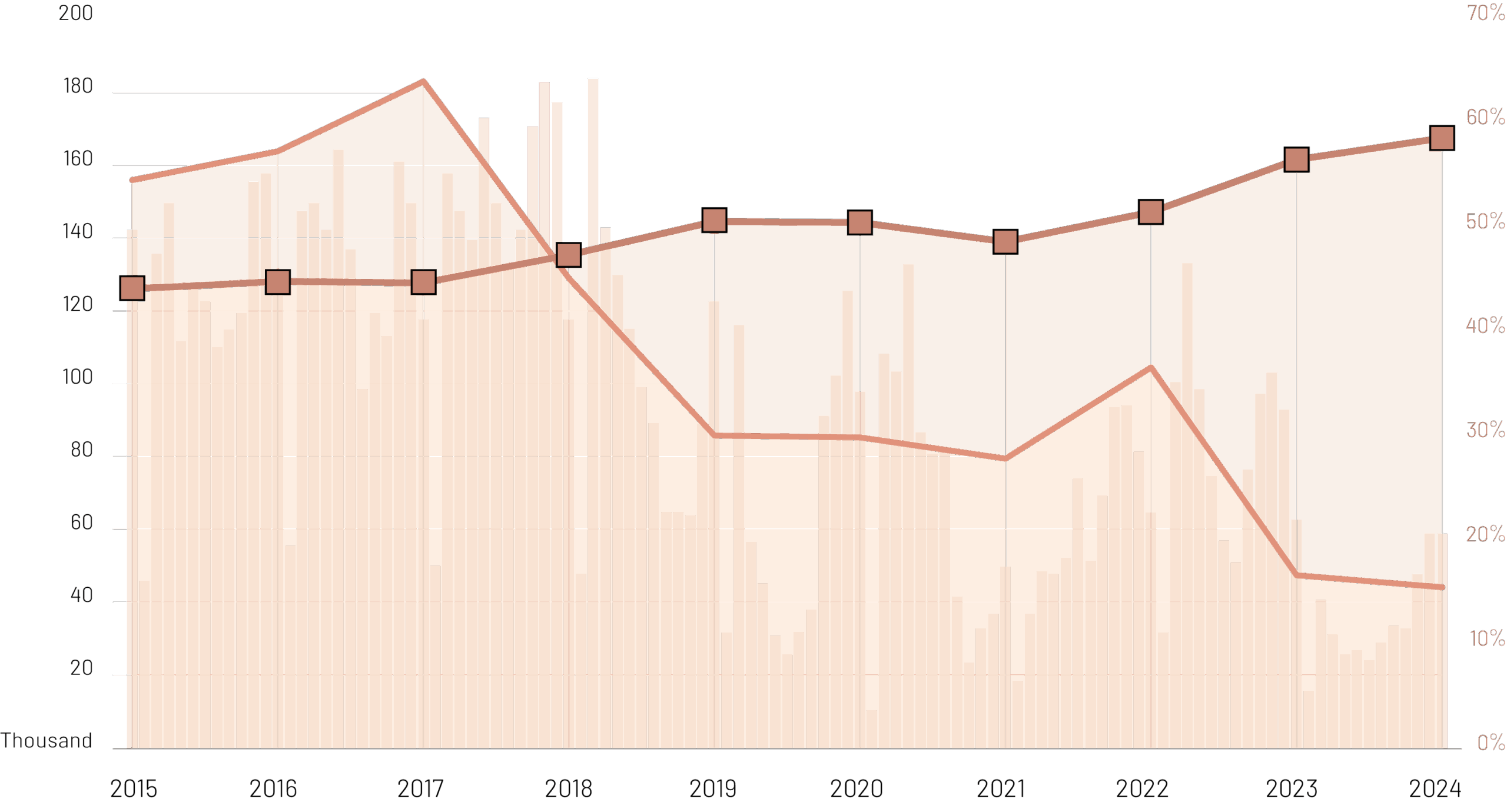

Although since the early 2000s the housing cost ratio in Tehran has consistently exceeded the standard threshold of around 40%, market data shows that around 2017 ( 1396 ), as this ratio increased further, the volume of transactions in Tehran fell by approximately 30% over two years—dropping from about 140,000 transactions to fewer than 100,000.

Share of Housing Costs in Total Household Expenditure Basket in Tehran

Monthly Housing Transactions in Tehran

Annual Housing Transactions in Tehran

Analyzing the Trends in Housing Expenditure Share and Real Estate Transaction Volume in Tehran

This progressive decline indicates that the shock of housing costs has exceeded the financial adaptability of households. Even an increase in supply over these years has not been able to restore effective demand to the market without reducing the financial burden on families. Given the lack of suitable alternatives, people effectively exit the market—this is just one of dozens of challenges facing Iran’s housing market.

Data shows that at times when prices increased by 15%, the number of transactions experienced a roughly 7% drop; crossing the "catastrophic expenditure" threshold has heightened demand sensitivity to price changes. Notably, even during downward price trends, the market reaction and transaction volumes have been nonlinear. In some periods, a 12% price decrease was met with as much as a 55% reduction in transaction volume.

Under such conditions, each percentage increase in price leads to an even sharper and accelerating drop in consumer transactions. This nonlinear response indicates that simply lowering housing prices is not enough to revive consumer demand. Factors such as:

• Disruptions in liquidity flow and reduced purchasing power

• Lack of widespread and appropriate financial tools (such as mortgage-backed securities)

• Intensified inflation expectations among buyers (lack of stability and confidence in the future)

have pushed buyers towards instability, passivity, and reduced demand.

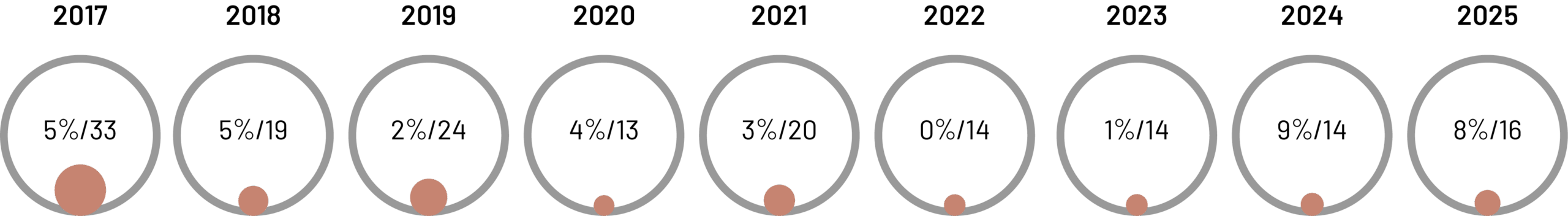

No-Loans

While in most countries effective housing loans cover at least 70% of the property purchase price, in recent years this rate in Iran has hovered around just 15%. This means that even if one manages to obtain financing, the amount and repayment terms are so ineffective that its practical use is almost impossible.

The loan-to-value (LTV) ratio chart for a residential unit in Tehran clearly illustrates the inadequacy of these facilities to stimulate or influence demand.

Average Value of a 75 m² Residential Unit in Tehran in the Same Year

LTV - Loan To Value

Ratio of Mortgage Loans to the Price of a Residential Apartment in Tehran

Seeking Remedies

In this situation, where households grapple with unstable economic policies, high inflation, and weak financial institutions and instruments, few effective solutions remain to revive consumer demand. Nevertheless, developing tools that stabilize prices while spreading costs over time or breaking down financial burdens appears to be one of the limited remaining options.

Potential measures include developing mortgage-backed securities, secondary markets and liquidity guarantees, fractional and gradual ownership models, forward purchase contracts at predetermined prices, cost indexing based on actual housing construction components, reducing information asymmetry through transparent housing data, and tax incentives for consumers.

Still, beyond any technical solution, rebuilding trust—through market stability and a redesigned housing finance system—is fundamental. Without these two pillars, policies aimed at bringing consumer demand back into the market will not succeed, and Iran’s housing market will remain in a state of paralysis.

Consumer demand depends on predictable policies and prices, affordable repayments relative to household income, and hope for the future. When these three foundations collapse, people abandon the dream of homeownership. Reviving consumer demand thus requires deep reform in financial policy design, anchoring inflation expectations, and revisiting modern financing and risk-coverage tools. Ignoring this trajectory will leave us with a market designed only for dollar-earning investors or those with free liquidity—a market without the people.

This content has been compiled and presented by the MINE team. Your feedback will undoubtedly make an invaluable contribution to advancing discourse around the housing market and enriching future content.

Sources used for this content:

Statistical Center of Iran | Central Bank of Iran

0