How private investment can improve senior

Design and Growth | Business Development | June 2025

Content we will read:

Senior housing | Investing in the construction industry

Reading time: 7 minutes

How private investment can improve senior-housing options

Senior housing—the spectrum of residential solutions aimed at people over age 65 —is a sector associated with many needs. By 2050 , the world is expected to have 1.6 billion people in this age cohort, more than double the number in 2021 , and about 33% of the total population in Iran.

Delivering more housing solutions that seniors want, need, and can afford—in a way that is manageable for developers and motivating for investors—is no simple endeavor. But amid an array of challenges, we see three long-term opportunities for senior-living providers that involve embracing change and investing in innovative solutions.

Challenges include: 1 - a high level of need 2 -lack of knowledge about offerings and 3 - elevated costs

One of the great triumphs of the modern age is the increase in human longevity. Between 1800 and 2017 , average global life expectancy more than doubled, from 30 years to 73 years. However, according to the McKinsey Health Institute’s research, on average, people spend about 50 percent of their lives in less-than-good health, including 12 percent in poor health.

Long life expectancy means that some countries now have enormous shares of population over the age of 65. The populations of Japan, Italy, and Germany, for example, include 30 , 24 , and 22 percent shares of seniors, respectively. In China, a comparatively modest 14 percent of the population is over the age of 65 but, because of China’s large population, that means the country has roughly 198 million seniors. According to assessments conducted in 2025 in Iran, the seniors constitute about 11.5 percent of the country's population, of which 47.7 percent are men and 52.3 percent are women.

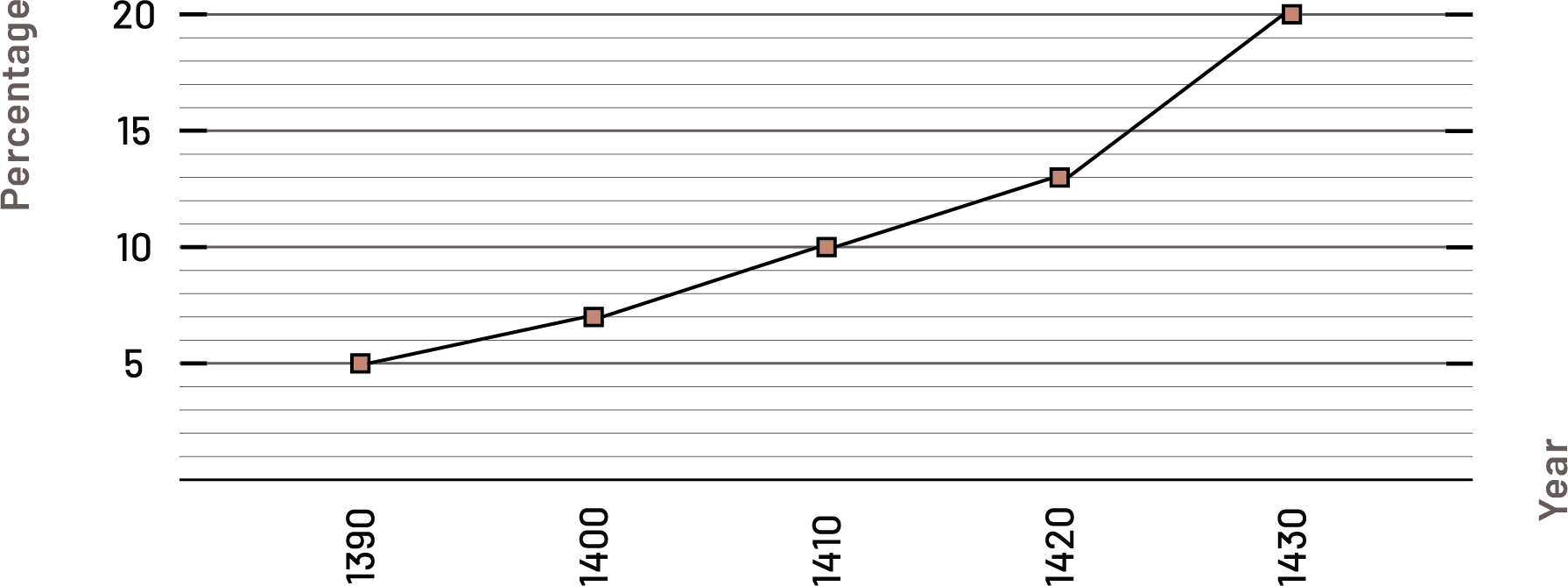

Iran's elderly population growth chart

Senior-living options are not widely understood

Globally, 80 percent of older adults want to live in their own homes, with many seniors only moving to senior-housing solutions at a point of absolute need

A spectrum of senior-housing types cater to an array of needs and desires. Many senior-living developments offer purpose-built residences designed for older adults that can be easily modified as they age and their care needs increase. Nonetheless, people may not fully understand the differences between senior-living developments—where most owners live independently—and nursing/care homes, which are designed to treat complex medical needs.

Opportunity: Support seniors who want to age in place

Retrofitting existing homes, and enhancing their safety and functionality, represents a strategic opportunity for the senior-housing industry to better serve this customer base. The retrofit business represents an opportunity to serve a vast population of older adults for years before they are ready to move, as well as those who will never move. It is also an opportunity to build relationships within the target demographic, potentially creating a pipeline for their main business.

Senior-living developers and operators can offer a home-augmentation design and installation service, using their expertise and brand positioning to offer a differentiated product to the market. Traditionally, local building and contracting companies have filled this gap. But senior-living companies have the in-house design expertise, supply chains, and brands to be able to offer more compelling solutions.

Retrofitting existing homes, and enhancing their safety and functionality, represents a strategic opportunity for the senior-housing industry .

Senior-living companies’ specialized knowledge can help transform homes for another life stage. They can mitigate the risk of typical age-related injuries and make daily activities easier by leveling access, widening doorways to accommodate wheelchairs, and installing stair lifts. Other customizations include bespoke doorknobs and switches, kitchen cabinets that can be lowered with the touch of a button, slip-resistant flooring, handrails, and smart-home technology. Such improvements can enhance seniors’ comfort and safety while helping them retain their independence and peace of mind.

For service providers, there are numerous benefits to entering the retrofit market. First, the market is large: As stated, roughly 95 percent of the world’s seniors age in their own homes, and many experience health and mobility challenges.

A future horizon of business innovation could help address the need for socialization: Where there is a nearby senior-living development, retrofit customers could be invited to join that community, benefiting from access to their amenities and social events.

More choices make it easier to consider senior living

The biggest competitor for a senior-housing development is not another development but rather the comfort and security of the senior’s current home. Our work with developers and operators in the sector suggests that offering potential residents more choices can make them feel more comfortable and secure with the transition.

In today’s market, two commercial models dominate the senior-development landscape: rentals and for-sale arrangements. Some markets have recently seen a rise in hybrid for-sale models, taking various forms. In Australia, the “land-lease” model has gained traction, where seniors own the homes they live in but lease the land beneath them. This model offers the advantage of lowering up-front purchase costs and provides a way to share maintenance expenses through the form of a service charge, easing the financial burdens on residents.

Many operators are also starting to offer “try before you buy” promotions, in which potential residents can rent for several months before committing to a purchase—significantly derisking the proposition in the eyes of the resident. Some developments have guest apartments where seniors and members of their family can stay for a weekend to experience the development.

Developers could also explore part-exchange or guaranteed-purchase schemes of the senior’s current home, as well as joint ventures with life or health insurance companies.

Reaching a senior’s community can be the most effective marketing

Operators can also think more holistically about how to expand their marketing to raise awareness of the benefits of senior-living residences and solutions. There are often multiple decision-makers and advisers involved in a move to senior living, including adult children, medical professionals, religious leaders, and wealth advisers. This education process could be realized by sponsoring or speaking at relevant wealth adviser and medical conferences, and through targeted advertising campaigns.

A potential resident’s adult children may be more reachable via social and digital media than their parents are. Some of them may be contributing to or entirely covering the cost of their parents’ purchase or rental, and so may be motivated to learn about the cost, quality, and care offered by senior-housing providers.

Opportunity: Improve quality of life by integrating digital solutions

Technology solutions aimed at those over 65 are booming. Senior-housing companies can use innovations in medical care, monitoring services, and connectivity solutions to improve the lives of their residents while also reducing operational costs.

Improving home functionality and enjoyment

Companies large and small have introduced a plethora of products that can be thoughtfully deployed to make seniors’ lives more. Voice- and device-controlled home automation can make it easy for seniors to do things including opening and closing curtains and adjusting cooling, heating, lighting, and music. Digital controls can also augment more analog design features such as adjustable beds and recliners or in-residence elevators. To help residents stay connected to their families and friends, large TV screens and hearing aids can be deployed to create user-friendly videoconferencing interfaces. Alternatively, video connectivity options more frequently seen in offices (such as portals) could be used, creating, for example, an entire video wall so that residents and their families can feel like they are inhabiting the same room.

Senior housing’s past performance has been strong

The senior-living market has demonstrated consistently superior performance relative to the overall rental market.

Senior-living developments present a tangible opportunity to generate both high returns and demonstrate a commitment to strategic goals, such as environmental, social, and governance principles. Senior housing can create a healthy, supportive environment for older adults, unburden them from maintaining homes (which can be occupied by families in need of housing), and, in some cases, manage seniors’ healthcare in a more efficient way.

conclusion

Creating an age-in-place senior-living alternative, offering more flexible sales models, marketing more effectively, and digitizing the experience can give the world’s seniors more and better options. The global population of adults aged 65 and older is growing at an unprecedented rate. For the senior-living industry, these demographics represent a golden opportunity to do more, do better, and do it all in innovative ways. What are your plans for this change?

Sources used for this content:

McKinsey & Company

0